Contents:

Nvidia and Intel, two of the largest companies of high-performance silicon, are in competition. However, shares of both Nvidia and Intel have slipped in 2022. The stock of Tata Motors has suddenly turned chirpy in last few days. On 16th February, the stock rallied by 3% and added another 1.7% on 17th February.

Microsoft Stock: AI Boom Doesn’t Justify Valuation Premium … – Seeking Alpha

Microsoft Stock: AI Boom Doesn’t Justify Valuation Premium ….

Posted: Thu, 27 Apr 2023 14:40:39 GMT [source]

In 2011, the company released its first mobile processor, the Tegra 3, which was used in a range of tablets and smartphones. After the initial failure of the NV1, Nvidia shifted its focus to the professional graphics market, releasing the RIVA 128 in 1997. This year will be some fight in the notebook market with intel’s Alder Lake CPUs.

GlobalData revises global growth projection for 2023 upward

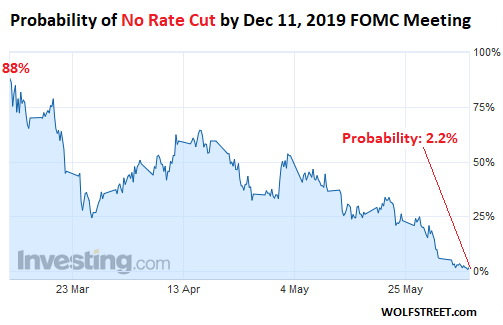

Analysts are recommending people to buy stock in CDK Global Inc. Keeping in consideration the previous trends, investment analysts are highly optimistic about Clouflare’s stock prices. With forecasts of exponential growth in the cybersecurity sector this stock is the right choice according to analysts. „Lower interest rates have certainly put some support underneath some of the more growth-oriented sectors,“ Northey said. Nvidia rose 2.8% after the chipmaker gave a weaker-than-expected quarterly forecast that many investors viewed as signaling the worst of a sales downturn may be over.

In a nutshell we cover almost everything that influence Business, Economy, Finance, Money, GDP, Growth & Development Of Country. Nvidia is one of the pioneers of outsourcing production and has never owned its own factories. Nvidia has said shortages have constrained its growth.Fiscal first-quarter revenue rose 84% to $5.66 billion and profit excluding certain costs was $3.66 a share in the period, which ended May 2, the company said. Analysts, on average, predicted earnings of $3.31 a share on sales of $5.41 billion. Today, it’s graphics processing technology is widely used in industries such as gaming, scientific research, artificial intelligence, data centres, and automotive computing. This has been driven largely by the demand for Nvidia’s graphics processing units in the gaming and data centre markets, as well as a significant increase in demand for GPUs for cryptocurrency mining.

This product was a commercial success, helping the company to establish a strong reputation for high-quality graphics processing. ARM is making Tiny bit of inroad into the server market last 3 quarters. This can give ARM some significant boost since it does not have to rely on Ampere graviton for making inroads into datacenter market. U.S. and European stocks have made a rocky start to 2022 with tensions that more aggressive monetary steps to tame inflation will hamper the recovery.

Tech has taken a lot of space in our everyday lives, for good ofcourse. With multi faceted developments in artificial intelligence, 5G and IoT there’s no market trend that can depict massive potential that tech companies hold for potential and existing investors. The yield on the closely watched 10-year Treasury note faded after recently hitting a two-month high. Declining interest rates tend to benefit technology stocks trading at high valuations. Inventiva cover entrepreneurship articles & stories and interviews of entrepreneurs, ceo, cxo, top management, reviews of products and services & tech, ai, ml, vr, analytics news. We also carry some very important aspects of internal & external trade, international affairs which directly or indirectly affects the global as well as Indian economy.

With its market value surging to new heights, Nvidia is well-positioned to continue leading the way in the tech industry and driving innovation in these fields. AMD exec Dan McNamara says enterprise server CPU sales will soon catch up with the fast growth of the chipmaker’s overall EPYC business. I do not see an earnings based reason for downgrades from analysts. Technology For You has always brought technology to the doorstep of the Industry through its exclusive content, updates, and expertise from industry leaders through its Online Tech News Website.

Tesla is an American company that develops clean energy electric vehicles for a sustainable future. Tesla’s diverse product line includes electric cars, solar panels, solar roof tiles, and energy storage home to grid based systems. Apart from performance issues, AMD’s FidelityFX Super Resolution software also falls apart when compared to Nvidia’s highly sophisticated Deep Learning Super Sampling . An important factor to consider is the increasing number of game developers optimizing their titles for Nvidia GPUs.

Earlier this month, Nvidia announced that it had reached a settlement with the SEC over disclosures in 2017 about how cryptocurrency mining drove the company’s growth. Nvidia said that its cryptocurrency-specific products, CMP, drove a 52% decline in other revenue, as revenue was “nominal” during the quarter. Nvidia beat analyst expectations for sales and earnings, but the stock dropped more than 10% in extended trading at one point after the chipmaker gave a light forecast for the current quarter. For investors in semiconductor companies, there is a series of events unfolding that they may pay attention to.

Game Up. RTX On.

Nvidia Corporation is an American technology company that specialises in designing and manufacturing advanced graphics processing units and other computer-related products. In a statement, post the signing of the deal, Nvidia confirmed that it had tied up with Jaguar Land Rover to jointly develop and deliver next-generation automated driving systems. These driving systems would be based on specially designed and AI-enabled microchips and related services for the customers of the carmaker.

This tie up for JLR with the world’s most advanced pure chip company puts them in a unique position to capitalize on the emerging trend of smart autonomous cars. The tie up between JLR and Nvidia is about tapping the huge electric car and smart car opportunity with the help of customized chips, where Nvidia has tremendous expertise. In the US markets, as the chip shortage has mounted, Nvidia has become the most valuable chip maker in the world with its market capitalization closing in on the $1 trillion mark. Nvidia focuses on the high value graphic and artificial intelligence chips. This diverse company has a potential to beat some big market players, investment analysts are optimistic about this company, it might hit the highest $72 in the upcoming months.

Open Free Demat Account

The Radeon GPUs can be seen faltering in every RT-intensive workload or video game. The adjusted gross margin, or the percentage of revenue left after deducting costs, will be 66.5%, the company said. The sales prediction compares with a $5.49 billion average analyst estimate, according to data compiled by Bloomberg. It’s success has made it one of the most valuable companies in the tech industry, with a market capitalization of over $450 billion as of 2021. The company continued to innovate and expand into new markets, including mobile devices and automotive computing.

Nvidia Stock Forecast — NVDA Chart for Technical Analysis (Will the … – The Motley Fool

Nvidia Stock Forecast — NVDA Chart for Technical Analysis (Will the ….

Posted: Thu, 09 Mar 2023 08:00:00 GMT [source]

Today, Nvidia is a dominant player in the GPU market and has expanded into new areas such as artificial intelligence and data centre computing. Another massive tailwind is from enterprise servers market. Enterprise customers do not change their platform for decades (as explained @ Semiconductor world – CPU/GPU Wars – #33 by kenshin ). One can see from the market share gains numbers that small market share gains for AMD converts to big revenue change since the market itself is huge compared to its current share. After Apple plonked two chips in package and called it ultra. But this one is for datacenter market and is called super chip.

The Nasdaq rallied on Thursday, lifted by gains in Nvidia and other technology-related stocks as investors focused on the Federal Reserve’s Jackson Hole conference for clues about the central bank’s policy outlook. Fed Chair Jerome Powell is due to give a speech on Friday that investors will dissect for indications of how aggressively the Fed may move to raise interest rates as it battles decades-high inflation. It has also made significant investments in AI technology and has developed several AI-focused products, including the Nvidia DGX system, which is designed for deep learning applications. The company is also involved in the development of other products such as system-on-a-chip units and mobile processors. Nvidia’s first product, the NV1, was released in 1995 and was a graphics accelerator designed for the PC gaming market.

Merits of Leveraging Automated Workload Analytics for Businesses

In conclusion, the 3070’s value proposition has improved significantly by May 2023. It’s now a more attractive option for those seeking a balance between what a p value tells you about statistical data and performance, as well as for creative professionals who rely on the Adobe suite. With a more competitive price point and a unique set of features, the 3070 is once again a worthy contender in the 1440p gaming market. As of May 2023, the prices of graphics cards have finally stabilized, and the RTX 3070 can be found at or below its original MSRP. With a more reasonable price tag, it’s essential to reassess its performance and value proposition.

- After Apple plonked two chips in package and called it ultra.

- Today, it’s graphics processing technology is widely used in industries such as gaming, scientific research, artificial intelligence, data centres, and automotive computing.

- It has also made significant investments in AI technology and has developed several AI-focused products, including the Nvidia DGX system, which is designed for deep learning applications.

- For investors in semiconductor companies, there is a series of events unfolding that they may pay attention to.

- Cybersecurity, Cloud Computing, Electric Vehicles, and Artificial Intelligence are the ruling industries of 2021.

- Nvidia Corporation is an American technology company that specialises in designing and manufacturing advanced graphics processing units and other computer-related products.

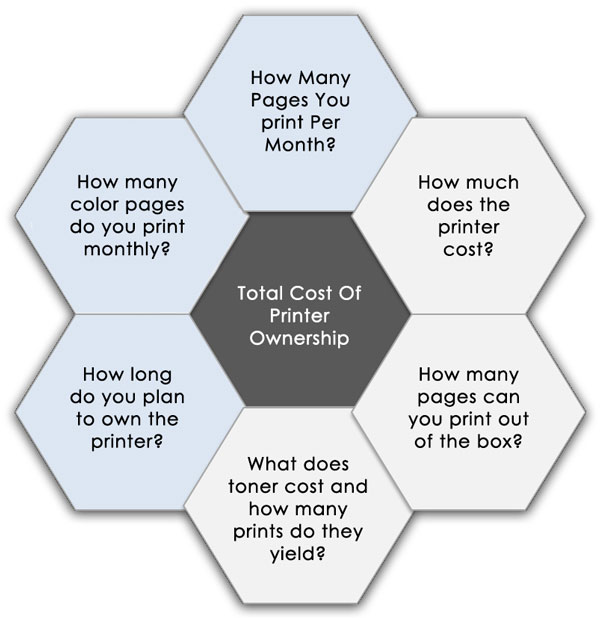

Clearly, it has a first mover advantage and wants to make the best of it. There is one more https://1investing.in/ that Tata Motors is looking to capture and that is the huge and lucrative market of the government push for electrification of India’s automobile fleet. It provides solutions in augmented reality, virtual reality and edge computing. Nvidia made $5.66 billion in the first quarter fiscal year 2022.Nvidia Gaming broke all previous records to reach $2.76 billion. The original competitor to the 3070 is the Radeon RX 6700 XT 8 GB GPU. This graphics card is currently available for $440. However, gamers looking to play at 1440p without spending extra for the RTX GPU can easily opt for this graphics card.

Analytics Insight® is an influential platform dedicated to insights, trends, and opinion from the world of data-driven technologies. It monitors developments, recognition, and achievements made by Artificial Intelligence, Big Data and Analytics companies across the globe. Both Nvidia and Intel have high margins, especially in the data center, but that also creates opportunities for both to be competitive on pricing besides just competing on performance. Nvidia is already growing at an impressive pace, Intel, on the other hand, is way cheaper, pays a nice dividend, and is on track to regain its mojo. For now, Tata Motors has already indicated that it will launch as many as 10 electric car models over the next five years in the domestic Indian market.

Synnex Corporation is an American company that provides logistics, integration services and technology solutions to customers. Synnex also provides professional and marketing services with specific emphasis on pre sales and post sales support. Synnex focuses on security, collaboration, networking and data centres. Nvidia’s stock price had been steadily climbing throughout 2020, but it really took off in early 2021 as the company continued to report strong earnings and revenue growth. This growth has been especially notable given the challenges faced by many companies during the COVID-19 pandemic.

That is nothing much to write home about but there is an interesting story building up around Tata Motors. The investors largely cheered the announcement that Jaguar Land Rover’s had signed a multi-year strategic partnership with Nvidia, the world’s largest producer of graphic and AI chips. This software-as-a-service platform enable businesses to purchase business softwares on a subscription basis. Salesforce’s first quarter revenue fiscal year 2022 rose to $5.96 billion. Salesforce is an American cloud based software company that focuses on the development of customer related management solutions. It provides one stop solution to business enterprises for stabilizing business and enhancing customer interaction experience.

Professional visualisation for workstations grew 67% annually to $622 million, but the company’s automotive business was down 10% on a year-over-year basis to $138 million. Effective 2025, all new vehicles manufactured by JLR will be built on the NVIDIA DRIVE software-defined platform. This will be part of the long term association between JLR and Nvidia. Cloudflare Inc. is an American web infrastructure company that provides DDos mitigation services and content delivery networks. Intelligent WAF, Bot Management, are a part of the company’s advanced security systems.

Nvidia forecasts decline in video gaming market, shares drop by 7%

Nvidia Corp., the largest U.S. chipmaker by market value, gave a bullish forecast on demand for chips used in gaming PCs and data centers. Revenue in the current quarter will be about $6.3 billion, plus or minus 2%, the Santa Clara, California-based company said in a statement late Wednesday. Every billionaire or a multi- millionaire’s story has one similar aspect and that is investing. Investing money is as integral to money multiplication as cryptocurrency fluctuations are to Elon Musk tweets pretty inseparable terms right?

- Tesla models that are released after 2021 come equipped with full self-driving mode.

- Ray-tracing performance on these graphics cards is not as good as Nvidia’s Ampere GPUs.

- It is in talks with TSMC, Foxconn, Samsung and LG for jointly bringing up ecosystem.

- Revenue from gaming doubled to $2.76 billion in the quarter.The stock was down less than 1% in extended trading following the announcement.

Last week Nvidia announced that it will split its stock 4 for 1 to try to accessible to investors and employees. Investment analysts have mapped the hidden potential of Synnex Corporation. Synnex Corporation is expected to hit $155.00 in the upcoming months. As this company is witnessing manifold increase in its stock price analysts are recommending investors to buy stock in Synnex Corporation.

Technology For You Provides Advertisers with a strong Digital Platform to reach lakhs of people in India as well as abroad. Earlier this year, Nvidia terminated a large purchase of Arm, a chip technology company. Nvidia said that it paid a $1.35 billion termination charge, which came out to a negative impact of 52 cents per share on a GAAP basis. Based on the softer market demand, Nvidia has chosen to reduce what it sells in the China market, he said. Nvidia is also taking a hit from Russia and sees „slower sell-through“ in Europe, he said. Chief Executive Jensen Huang told Reuters that Nvidia’s gaming business revenue will post a percentage drop in the mid-teens for the current quarter compared with the previous quarter.

Geforce graphics cards are better geared towards creative professionals. The entire Adobe suite is better optimized for Nvidia GPUs. Ray-tracing performance on these graphics cards is not as good as Nvidia’s Ampere GPUs.

Mega tech stocks lure back investors for all seasons – Hellenic Shipping News Worldwide

Mega tech stocks lure back investors for all seasons.

Posted: Fri, 28 Apr 2023 21:37:55 GMT [source]

AMD showcasing efficiency in APU (performance/power consumption). In Feb Zen3+ 3D vcache may get them the crown and zen4 will very likely beat this one again in 2H 22. Nvidia said its board has authorized an additional $15 billion in share buybacks through the end of next year. It spent $2.1 billion on share buybacks and dividends in the first quarter. Nvidia CEO Jensen Huang said that the company was facing a “challenging macro environment” in a statement. The company’s operating expenses increased 35% year-over-year to $1.6 billion on a non-GAAP basis.